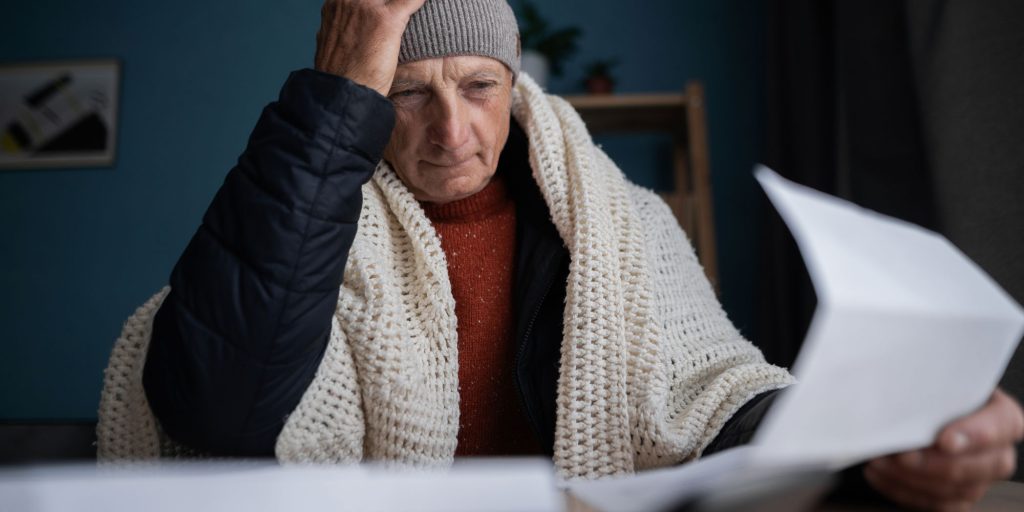

Winter in New Zealand can be a beautiful season—crisp mornings, cosy evenings, and maybe even a dusting of snow if you’re lucky. But it also brings higher power bills as we try to keep our homes warm and comfortable.

If it feels like power keeps getting more expensive, you’re not imagining it. Recent Stats NZ data shows power prices are rising faster than inflation, with the fixed charge going up an average of 21 percent year-on-year.

On top of that, power prices rose further this year because the commerce commission increased the revenue limits for lines companies. This could set households back up to $300 per year.

These price rises are hard to swallow for many people. According to EECA, 83% of Kiwis are concerned about rising energy costs, and many are unsure how to manage their energy use effectively . The good news? With a few smart tweaks, you can reduce your power bill without sacrificing comfort. Here are six practical tips to help you save on energy this winter.

1. Seal Draughts and Only Heat the Rooms You Use

Draughts are a common issue in many Kiwi homes, especially older ones. Gaps around doors and windows let warm air escape and cold air in, making your heating work harder.

Simple fixes include:

- Using draught stoppers or door snakes.

- Applying weather stripping to windows and doors.

- Sealing gaps in floorboards and around skirting boards.

By sealing draughts and only heating the rooms you’re using, you could save up to $350 annually.

2. Switch to Cold Water Washes

Heating water accounts for about 30% of the average household’s energy use. By washing your clothes in cold water, you can reduce your energy consumption without compromising on cleanliness.

This simple change can save you up to $50 per year.

3. Turn Off Unused Appliances

Many appliances consume power even when they’re not in use—a phenomenon known as “vampire power.” Devices like TVs, chargers, and microwaves can add up over time.

Tips to reduce standby power:

- Unplug devices when not in use.

- Use power strips to turn off multiple devices at once.

- Invest in smart plugs to schedule appliance usage.

Switching off unused appliances can save up to $200 annually.

4. Make the Most of Curtains and Rugs

Curtains and rugs aren’t just decorative—they’re functional too. During the day, open your curtains to let in natural sunlight. At dusk, close them to retain heat. Rugs can also help insulate your floors, keeping rooms warmer.

These simple actions can contribute to a warmer home and lower heating costs.

5. Use Your Heat Pump Efficiently

Heat pumps are among the most energy-efficient heating options available. However, their efficiency depends on proper use.

Best practices include:

- Setting the temperature to a comfortable level (around 18–21°C).

- Avoiding the “Auto” mode; use “Heat” mode instead.

- Regularly cleaning filters to maintain airflow.

Efficient use of your heat pump ensures optimal performance and energy savings.

6. Check You're on the Best Power Plan

Not all power plans are created equal. Your current plan might not be the most cost-effective for your usage patterns. By comparing different providers and plans, you could find a better deal.

Using comparison tools like Powerswitch in conjunction with the tips mentioned above could help you identify potential savings of up to $500 annually.

Need a Hand Managing Winter Expenses?

Even with these energy-saving tips, winter can strain your budget. Unexpected expenses or higher bills can make things challenging. That’s where East Bay Finance comes in.

We offer quick, affordable personal loans to help you manage your finances during the colder months. Our online application takes just 2 minutes, with approvals typically within 1–2 hours*. Funds can be in your account the same day*.

With East Bay Finance you get:

- Access to multiple lenders, increasing your chances of approval.

- Competitive rates: secured loans from 9.95%*, unsecured from 11.95%*.

- Borrow up to $75,000 unsecured or $150,000 secured.

- Bad credit? No problem! We believe in second chances.

- Expert local advice from our friendly loan advisors.

Don’t let winter expenses get you down. Apply now and take control of your finances.

*Subject to responsible lending checks and criteria